- Home

- About the Trust Bank

- CSR

- Initiative to ESG Investment

Initiative to ESG Investment

Our policy

We, as institutional investors, support the Principles for Responsible Investment and make investments with consideration for ESG factors.

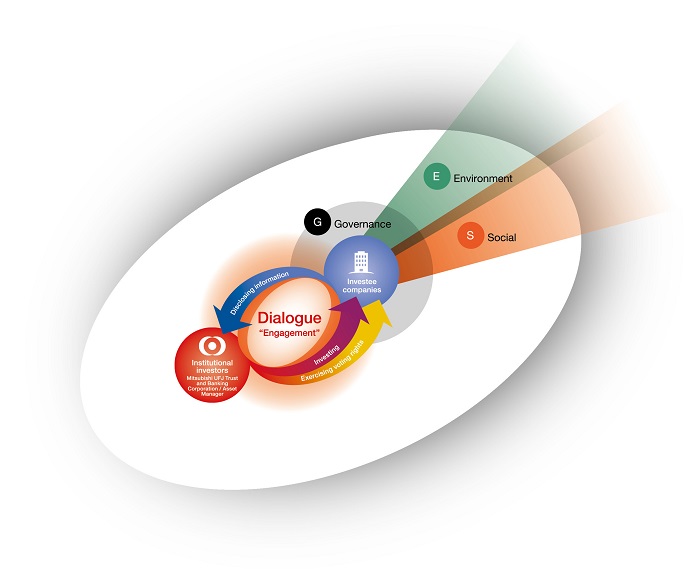

We believe that considering ESG factors in the investment decision-making process will lead to the establishment of sustainable companies. We place an emphasis on governance (G) and carefully evaluate environmental (E) and social (S) issues to determine whether or not to respond to them as business challenges. It is thought that companies with an appropriate governance structure in place are capable of solving environmental and social issues whilst maintaining growth. We believe that we can assist our investees to achieve sustainable growth by evaluating their environmental, social, and governance situations and conducting dialogue and investment activities with an awareness of the risks and opportunities involved. In this way, we can improve investment performance and contribute to the creation of a sustainable society.

ESG investing is thought to decrease medium- to long-term risks and improve performance. We make use of our experience of corporate evaluations based on non-financial information to set up and manage funds consisting of carefully selected companies that we believe capable of sustainable profit growth. We apply these principles to both active and passive funds and are developing new indexes and bond management methods that take ESG into account.